The recent agreement between China and the United States to gradually lower mutual tariffs marks a turning point for global trade. For paper exporters like us, this policy shift is not just welcome news, it's a strategic opportunity to reconfigure supply chains, reduce costs, and re-engage with key overseas markets.

As part of the agreement, the U.S. will reduce tariffs on Chinese goods from 145% to 30%, while China will lower tariffs on American imports from 125% to similar levels. For our business, which deals extensively in wood pulp-based paper products, this directly translates to lower raw material prices and improved profit margins.

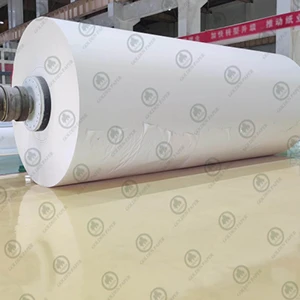

In particular, the easing of tariffs on imported softwood pulp from the U.S. is already impacting sourcing decisions. CIF prices for U.S. long-fiber pulp are expected to fall below $900/ton, giving us more flexibility to secure stable, high-quality pulp supply at reduced costs. This supports the production of high-end paper grades, such as ivory board, offset paper, and C1S/C2S coated paper, for our export clients.

One of the most immediate benefits we're seeing is the reopening of the U.S. market for Chinese paper products, especially household paper and packaging grades. Before the tariff hike, the U.S. was one of our key destinations for base paper and semi-finished materials. With tariffs lowered, we anticipate a return to pre-trade war volumes in some categories over the next 12 to 18 months.

While direct exports to the U.S. will regain momentum, we also expect indirect exports, packaging paper used in Chinese-manufactured goods shipped globally, to increase in tandem with a broader recovery in China's export sector.

Although the U.S. is regaining importance, we're not reverting to a single-market focus. The ASEAN region, bolstered by the RCEP framework, has already shown strong growth in paper imports from China. For example, in early 2025, our shipments to Southeast Asia rose more than 20% year-on-year. We plan to continue diversifying geographically to mitigate policy risks and meet growing demand across emerging markets.

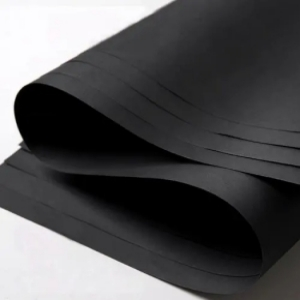

With raw material costs coming down, now is the time to accelerate the shift toward high-margin, value-added paper products. From decorative base paper to food-grade boards and medical packaging, demand for specialty grades is rising. We are actively expanding our portfolio in this area, helping customers secure consistent quality with reliable export logistics support.

Biodegradable and recyclable paper products are also seeing a global surge in interest. The tariff reduction helps us price these eco-friendly products more competitively, especially in markets where sustainability is a key purchasing factor.

The new tariff environment offers short-term relief, but long-term success will require agility. We are enhancing our raw material procurement strategies, investing in more cost-effective supply routes, and closely monitoring global pulp trends to maintain pricing stability for our clients.

At the same time, we are working with customers to optimize container loading, minimize lead times, and improve documentation efficiency, ensuring that the benefits of policy shifts translate into real business gains.

The China-U.S. tariff reduction marks a rare opening in an often uncertain trade environment. For paper exporters like us, it is both a relief and a responsibility. By reducing costs, expanding reach, and upgrading product lines, we Golden Paper are ready to seize this window of opportunity, and help our customers do the same.

GOLDEN PAPER

GOLDEN PAPER

EN

EN

fr

fr  de

de  es

es  it

it  ru

ru  pt

pt  ar

ar  vi

vi  tr

tr  id

id